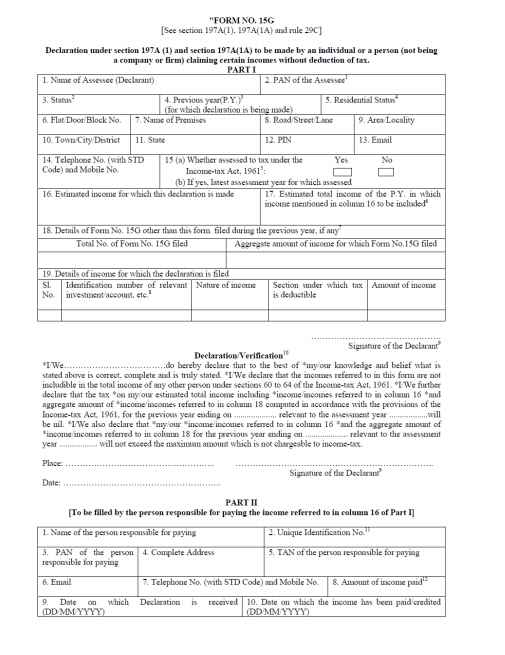

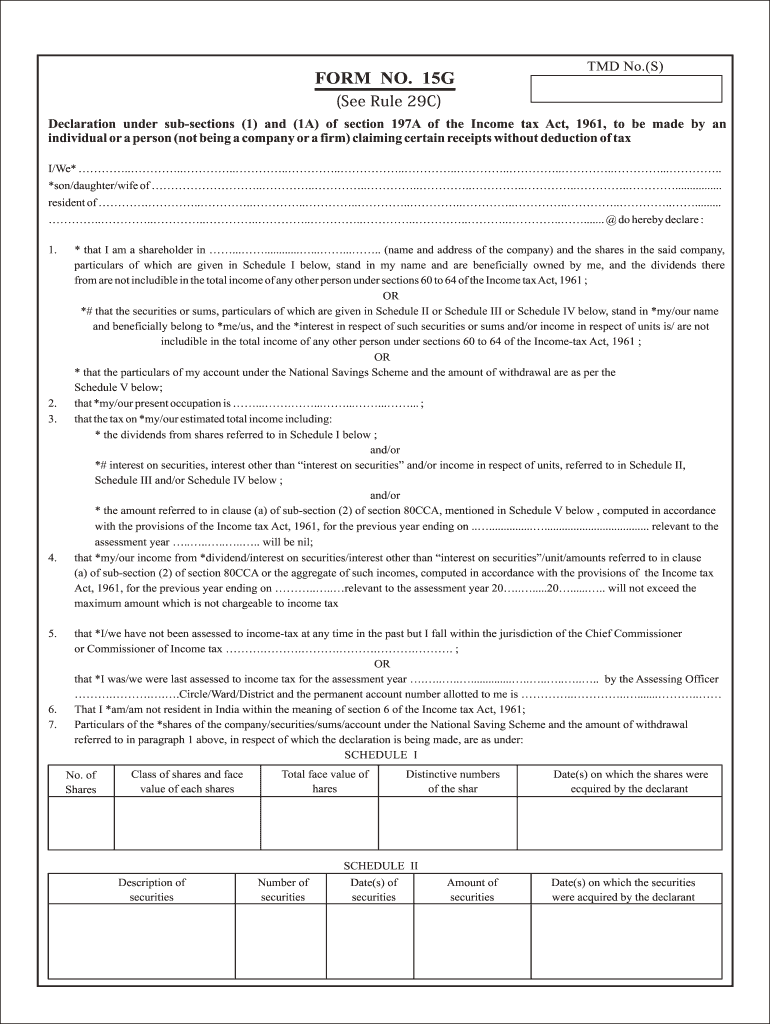

Lastly, enter the details of investment interest income.Details of estimated income for which declaration is made.Tick mark on “yes” if you have been assessed to tax under the Income Tax Act 1961 and mentioned the latest assessment year of returns.Residential status, address details, PIN code.

All that a taxpayer needs to do is to download the form online and fill in the accurate details and submit it. The process to submit Form 15G has been digitized by the Central Board of Direct Taxes (CBDT). How To Download PF Withdrawal Form 15G Online? So, what is this Form 15G, how to fill and submit this form and how is it helpful in avoiding TDS deductions? Learn all this in detail through this article on Form 15G for PF withdrawal. However, the Employees Provident Fund Organization (EPFO) has introduced Form 15G for PF withdrawal, which facilitates PF members to pre-withdraw their PF online without any TDS deduction. Form 15G for provident fund (PF) withdrawal is a self-declaration form which ensures the applicant that there will be no deduction of TDS (tax deduction at source), if they withdraw their provident fund before, in a given financial year.Īs per the income tax rules, if an employee withdraws from the provident fund before completing five years with the current organization and withdraws more than INR 50,000, then TDS would be deducted.

0 kommentar(er)

0 kommentar(er)